davis county utah sales tax rate

Including county and city sales taxes the highest total sales tax is in Arab Alabama 1350. Joseph Jarvis gave a summary of why there is a need for a sales tax increase.

Hamilton County collects on average 153 of a propertys assessed fair market value as property tax.

. Click here for a larger sales tax map or here for a sales tax table. Sales tax is calculated by multiplying the purchase price by the applicable tax rate. Mississippi has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 1There are a total of 142 local tax jurisdictions across the state collecting an average local tax of 0065.

The median property tax in Idaho is 118800 per year for a home worth the median value of 17170000. Click here for a larger sales tax map or here for a sales tax table. Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes.

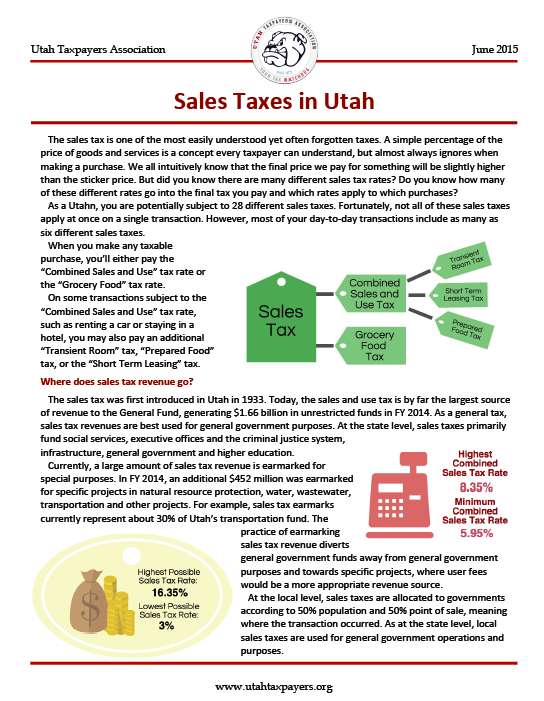

The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200. 2 2021 town council meeting the first reading of Ordinance O2022-01 Sales Tax Rate Change was done. Combined with the state sales tax the highest sales tax rate in Utah is 905 in the city of Park.

Combined with the state sales tax the highest sales tax rate in Mississippi is 8 in the cities of. In Provo the total rate is 1136. Gary Herbert announced that his 2017 tax plan includes a deal with Amazon to start collecting sales tax on Utah purchases.

The seller collects it at the time of the sale. The largest recipient of the tax in Provo is the school district which accounts for about 70 of the total tax. Under Utah state law internet retailers are only required to collect sales tax for online sales if they have a physical presence and Amazon does not have a physical presence in Utah.

Situated along the eastern bank of the Great Salt Lake Davis County has property tax rates somewhat higher than the state average but lower than the rates in nearby Salt Lake County. Idaho has one of the lowest median property tax rates in the United States with only thirteen states collecting a lower median property tax than Idaho. However on December 7 2016 Gov.

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335There are a total of 129 local tax jurisdictions across the state collecting an average local tax of 2108. Counties in Idaho collect an average of 069 of a propertys assesed fair market value as property tax per year. California has the highest base sales tax rate 725.

At the Dec.

Suicide Rates In Utah Are High But Covid 19 Pandemic Hasn T Made Them Worse Study Says

Utah Sales Tax On Cars Everything You Need To Know

Utah Sales Tax Rate Increases Take Effect April 1 2019

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22668019/rent_rate_increase_rgb_v1.jpg)

Why Are Utah Rent Rates So Expensive The Latest On Utah Housing Deseret News