tax effective strategies for high income earners

That works out to an overall tax rate of about 12 on the part of your income thats taxable. As of November 2018 there are two rates of corporation tax CT in the Republic of Ireland.

The 4 Tax Strategies For High Income Earners You Should Bookmark

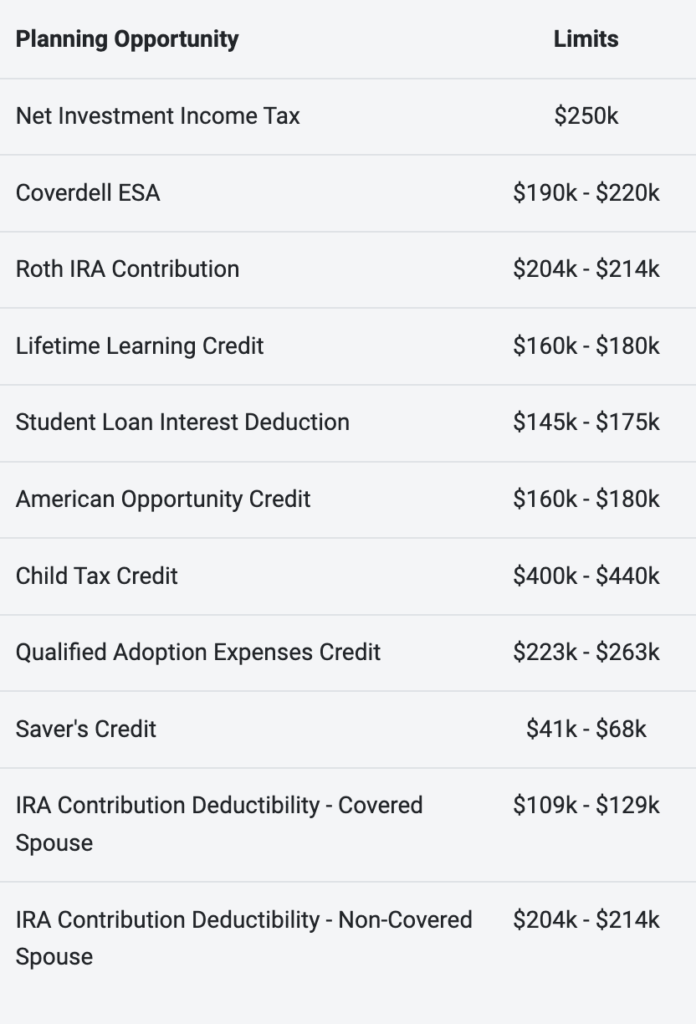

Here are some strategies for getting your tax bill lower.

. High-income individuals pay more in taxes as a percentage of their taxable incomes than low-income earners. In 2018 and for the first time in US. A 250 headline rate for non-trading income or also called passive income in the Irish tax code.

Billionaires paid a lower effective tax rate than the working class. Contributing to a retirement plan is the easiest and. Your effective tax rate will.

The Tax Cuts and Jobs Act of 2017President Trumps massive tax cut law that mostly benefits wealthy Americans and corporations created Opportunity Zones 8700 ZIP codes where governors have determined a need for more investment and where those who do invest will. Any reduction in your gross income - AGI - MAGI - taxable income will lead to a reduction in your taxes. A study found that the average effective tax rate paid by the richest 400 families in the country was 23 percent a full percentage point lower than the 242 percent rate paid by the bottom half of American households.

Opportunity ZonesA Potential New Challenge in the Fight against Gentrification. A 125 headline rate for trading income or active businesses income in the Irish tax code. Your taxable income would be 72000 if youre a single filer with an income of 84550 and if you were to take the 2021 standard deduction of 12550.

Contribute to IRA 401k plan. Trading relates to conducting a business not investment trading.

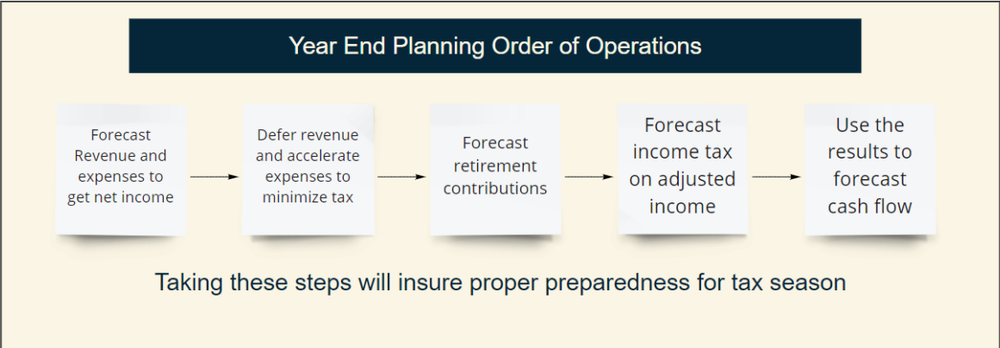

7 Smart Ways High Earners Can Prep For A Smoother Tax Season Wingate Wealth Advisors

The 199a Qbi Deduction Production Income Strategy

Tax Strategies For High Income Earners Pillar Wealth Management

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

Tax Reduction Strategies For Executives And High Income Earners 2022 Podcast Kathmere Capital Management

13 People 13 Different Retirement Numbers As Evidenced Swr And Retirement Numbers Are Early Retirement Retirement Advice Financial Independence Retire Early

The 4 Tax Strategies For High Income Earners You Should Bookmark

How To Set Up A Backdoor Roth Ira For High Income Earners Money Management Money Management Advice Money Saving Strategies

Pin On Best Of The Millennial Budget

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

The 4 Tax Strategies For High Income Earners You Should Bookmark

Safe Portfolio Withdrawal Rates Success Rate Success Investing For Retirement

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

5 Outstanding Tax Strategies For High Income Earners

13 People 13 Different Retirement Numbers As Evidenced Swr And Retirement Numbers Are A Very Personal Decision Early Retirement Retirement Advice Retirement

Can Financial Advisors Get Paid For A 1 Page Financial Plan Financial Planning How To Plan Planning Essentials